Hamilton “Tony” James — the president of the Blackstone Group, the nation’s largest private equity firm — is hosting a $35,800-a-head dinner for Obama, with 60 Democratic allies expected to attend, according to a campaign official. Many in attendance are expected to have ties to the private equity sector.What makes the timing particularly interesting is that Monday also marked the beginning of the Obama campaign's latest round of attacks on Mitt Romney's record at the private equity firm he once headed, Bain Capital, even going so far as to set up a separate website called Romney Economics. (I should at least in passing gratefully acknowledge that so far the Obama campaign has resisted employing the term "Romneynomics.") One of the banners on the website reads "The Romney Model" and clicking on it brings up the following:

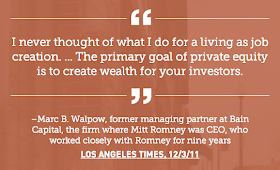

This is of course meant to evoke memories of the fictitious Gordon Gekko's (protrayed by Michael Douglas) infamous "Greed is good" credo from the film "Wall Street." Bain, and by extension, Romney, cared nothing for workers, only for profit. A video produced by the Obama campaign even contains a quote from someone who lost a job at a company Bain managed calling the equity firm a "vampire."

So is the President's fundraiser of choice today a different kind of vampire, er, equity capitalist? The Blackstone Group lays out its mission on its website under the heading "Our Approach."

Blackstone’s primary objective is to manage our business — and our Limited Partners’ capital — with care, discipline and patience. We strive to deliver compelling risk-adjusted returns over the long term. Many of our investment vehicles, such as our corporate and real estate private equity funds and credit funds, are structured with lives of up to ten years or longer. This long-range view enables us not only to ride out market cycles, but also to maximize value through operational improvements over time. [emphasis added]At this point you are probably asking yourself, "Where is the part about 'creating jobs'?" I, too, searched in vain for it. Even more shocking are these quotes from "Selected Transactions" also on the Blackstone Group website [emphasis added]:

- Kraft executed the transaction as a tax-free split-off and merger to maximize after-tax shareholder value and realized approximately $2.6 billion in value.

- Stiefel’s objective was to ... maximize value for its shareholders. Stiefel and Blackstone determined that a sale process may be able to create superior shareholder value and pursued a targeted auction including the most viable strategic parties.

- As part of this process, Blackstone evaluated and executed asset sales to maximize overall value.

Despite the unparalleled success of the free market/capitalist system in the United States that has eclipsed all other nations in history, even with its warts, in the degree and widespread nature of the prosperity it has produced, there are still many who get squeamish about the dog-eat-dog perception with which free markets are often caricatured. Certainly there are excesses, greed, cruelty, and injustice, and God has ordained governments to keep such proclivities of mankind in check. Laws and regulations and the reach of both will be a constant source of push and pull between business, government, and society at large. Our system has flaws and has room for improvement, but compared to all others, there frankly is no comparison. And based on the President's $35,800 per plate fundraiser today, after deducting for food, travel, and Hope 'n Change napkins, I have no doubt his 2012 election campaign has turned a fairly healthy "profit." The President may decry the carnage left behind by greedy vampires in private business in their thirst for greater and greater returns, but he knows that even in his business, politics, money is the lifeblood.

No comments:

Post a Comment