President Obama is committed to growing our economy from the middle out by ensuring a strong, secure, and thriving middle-class. That’s why his top priority is promoting jobs and growth while reducing our deficit in a balanced and responsible way.So if President Obama has saved the average middle class family $3,600 over the past four years, how is that same family facing an increase of $2,200 in 2013? The answer is that the two amounts are entire unrelated. The president has repeated cited the $3,600 figure throughout the campaign, sometimes even giving the impression that it was an annual savings. The details on that $3,600, however, were given rather infrequently. Interestingly, the clearest explanation I found was in a previous National Economic Council report from July 2012.

Since taking office, President Obama has repeatedly cut taxes for middle-class families to make it easier for them to make ends meet. A typical family making $50,000 a year has received tax cuts totaling $3,600 over the past four years – more if it was putting a child through college.

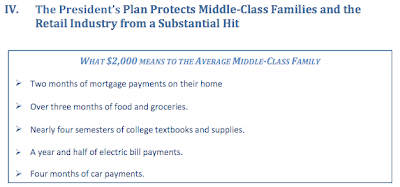

Now we face a deadline that requires action on jobs, taxes and deficits by the end of the year. If Congress fails to act, every American family’s taxes will automatically go up - including the 98 percent of Americans who make less than $250,000 a year and the 97 percent of small businesses that earn less than $250,000 a year. A typical middle-class family of four would see its taxes rise by $2,200.

A typical family making $50,000 a year has seen their taxes cut by $3,600 over the last four years, $800 in each of 2009 and 2010 due to the Making Work Pay tax credit and $1,000 in each of 2011 and 2012 due to the payroll tax cut.The $3,600, therefore, is composed of the Making Work Pay tax credit which expired after 2010, and the payroll tax holiday, set to expire at the end of 2012. As I have detailed extensively recently, the president has gone out of his way to give the impression that if his plan is passed, middle class families won't see their taxes increase a single dime. Indeed, the NEC and the CEA in today's report assure us:

President Obama has stood for providing certainty to more than 100 million middle-class families that their taxes will not go up on January 1st.But since the payroll tax holiday extension is not currently part of the president's plan, this statement is patently false. Even if the GOP completely caves and passes the president's plan as presented to preserve the Bush Tax Cuts only for those earning under $250,000, that average middle class family will still see a $1,000 tax increase.

This hidden tax increase which today's report completely ignores undercuts the entire argument of the report. The premise of the report is the economic damage that will be caused by a middle class tax increase, and indeed may even be caused by the mere threat of such an increase due to the uncertainty of the "fiscal cliff" negotiations. But if the threat of a $2,200 tax increase is damaging, certainly a $1,000 payroll tax increase is nothing to sneeze at. In fact, towards the end of the report, the following is presented:

Is $2,000 a "substantial hit," but $1,000 is not? The chart could be revised to read:

WHAT $1,000 MEANS TO THE AVERAGE MIDDLE-CLASS FAMILYBesides all this, the payroll tax increase will hit everyone, even the working poor. Someone earning only half of the "average middle class family" ($25,000) would be hit with a $500/year increase in payroll taxes.

One month of mortgage payments on their home

Six weeks of food and groceries.

Nearly two semesters of college textbooks and supplies.

Nine months of electric bill payments.

Two months of car payments.

In 2011, the payroll tax holiday warranted the What $40 Means campaign from the White House which produced thousands of stories of near destitution that its expiration would cause. Unless the White House is holding the extension in its back pocket as a trump card to outplay the GOP in the "fiscal cliff" negotiations, it will be interesting to see how the public reacts to suddenly smaller paychecks in January 2013 when everyone was kept under the illusion that "President Obama has stood for providing certainty to more than 100 million middle-class families that their taxes will not go up on January 1st."

Time is running out for taxpayers, and time is also running out for the GOP to take the initiative on this issue. At the moment Republicans seem to be going soft on the 20 year old Grover Norquist tax pledge, they have a chance to expose the president's charade and reaffirm that this is not a time to raise anyone's taxes. John Boehner needs to get in front of every camera in Washington he can find and ask, "Why is President Obama trying to sneak through a tax increase that hits the middle class and working poor the hardest? Which is worse: Extending current tax rates for everyone? Or taking $500 from a poor working family or $1,000 from a middle class family? Is this part of the "fun" Jay Carney was talking about?"

It's time the tables were turned. Let's see the White House on the defensive for once. At the very least, it will provide some catharsis for November 6th. At best, it will spare Americans a tax increase and show that Republicans really do have all Americans' best interests at heart.

No comments:

Post a Comment